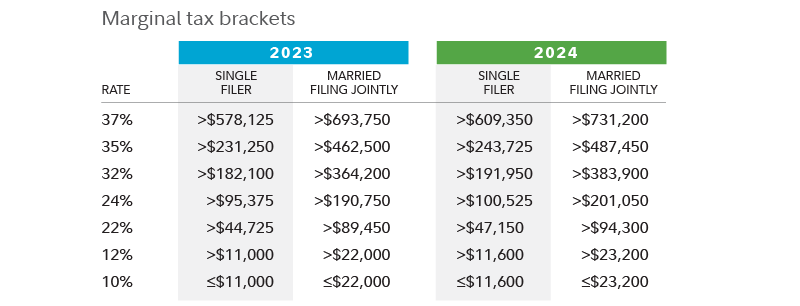

2024 Tax Brackets California – What taxes will you owe on your capital gains? With a big year in the stock market in 2023 you could be facing a large tax bill. . There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. .

2024 Tax Brackets California

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Kick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

IRS announced new tax brackets for 2024—here’s what to know

Source : www.cnbc.com

2024 Tax Brackets California IRS: Here are the new income tax brackets for 2024: the impact is more significant for individuals in lower tax brackets. Analysis of tax years 2020 and 2021 reveals that those moving from California to other states had an average gross income of about . A tax refund advance allows people to access their refunds early, but when is it and how much can you claim back? The advantage of accessing the refund advance is that you essentia .